Launching a business is exciting, but financial management can quickly become a headache. Fear not! Sparkling clean books are within reach. This guide equips you with the essential knowledge to keep your finances organized and your startup thriving.

Why Bookkeeping Matters for Startups:

- Financial Clarity: Track income, expenses, and profitability to make informed decisions about pricing, staffing, and growth.

- Tax Compliance: Avoid penalties and ensure accurate tax reporting with organized records.

- Growth Potential: Analyze financial data to identify cost-saving opportunities and optimize your business model.

Building Your Foundation:

- Choose Your Structure: Select a business structure (sole proprietorship, LLC, etc.) that aligns with your legal and tax needs.

- Open a Dedicated Bank Account: Separate personal and business finances for clearer tracking and legal compliance.

- Invest in Accounting Software: Streamline your bookkeeping process with user-friendly software.

The Basics of Bookkeeping:

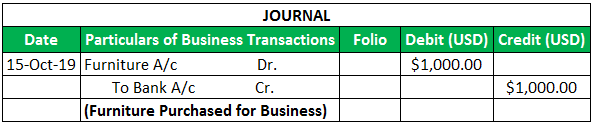

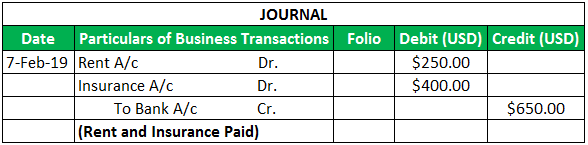

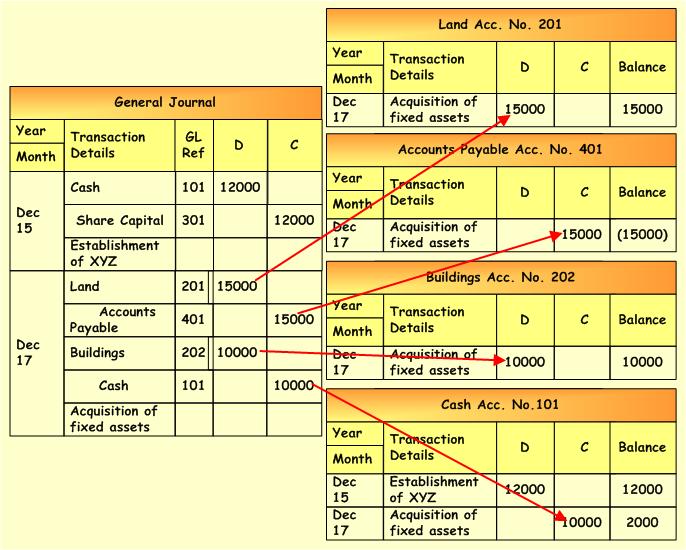

- Debits and Credits: Understand these fundamental accounting terms to record transactions accurately.

- Journals and Ledgers: Master these tools to systematically record and organize your financial activity.

- Payroll: Track employee wages and taxes to ensure compliance and avoid penalties.

- Invoicing: Create and track invoices to ensure timely payments from customers.

Common Pitfalls to Avoid:

- Skipping Professional Help: While DIY bookkeeping may seem tempting, errors can be costly. Consider outsourcing to experienced professionals.

- Mixing Personal and Business Finances: Maintain separate accounts for clear financial records and legal protection.

- Cash Accounting: Opt for accrual accounting for a more accurate picture of your financial performance.

- Improper Chart of Accounts: Tailor your chart of accounts to your specific business needs for efficient tracking.

- Procrastinating on Bookkeeping: Stay organized by regularly updating your records to avoid last-minute stress.

- Neglecting Reconciliation: Regularly reconcile bank statements and credit cards to ensure accuracy.

- Ignoring Taxes: Keep meticulous records to simplify tax filing and avoid penalties.

- Failing to Back Up Data: Protect your financial data by regularly backing it up to the cloud or an external hard drive.

Outsource for Success:

As your business grows, bookkeeping demands increase. Outsourcing to experienced professionals offers several benefits:

- Time Savings: Focus on growing your business while experts handle your finances.

- Accuracy and Expertise: Benefit from their knowledge and avoid costly mistakes.

- Reduced Costs: Compared to in-house accountants, outsourcing can be more cost-effective.

Your Partner in Growth

We are dedicated to helping startups like yours achieve financial success. Our team of experienced bookkeepers offers:

- Accurate and Timely Bookkeeping: We keep your records clean and organized.

- Strategic Insights: We analyze your finances to provide valuable insights for growth.

- Affordable Solutions: We offer flexible and budget-friendly bookkeeping services.