In the fast-paced world of retail, accurate inventory management is key to success. Enter retail accounting, a technique specifically designed to simplify this crucial task.

While not a separate financial activity, retail accounting boasts unique characteristics, like increased focus on inventory, which we’ll dive into here.

Why is understanding retail accounting crucial?

- Informed decision-making: Knowing your inventory value unlocks accurate cost of goods sold (COGS) calculations, crucial for financial reports and strategic planning.

- Streamlined processes: The retail method bypasses physical countings, saving time and resources.

- Peace of mind: Gain clarity on your financial health and avoid costly inventory surprises.

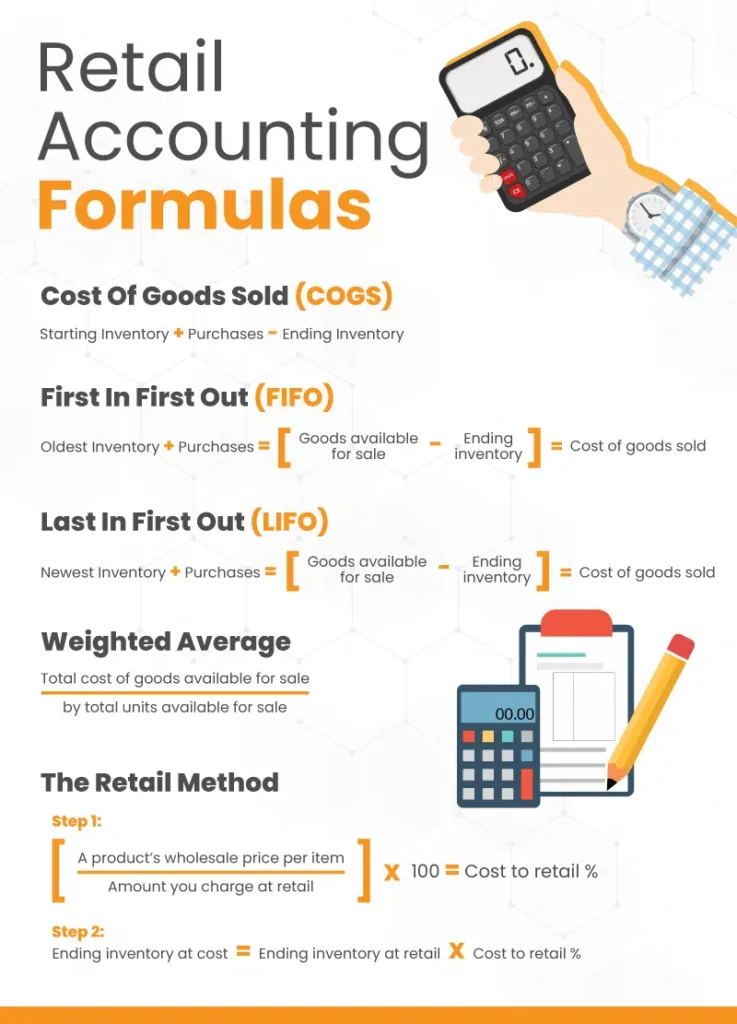

How does the retail method work?

Imagine a magic formula that transforms your stock into its retail value – that’s essentially what the retail method does. It estimates inventory cost based on the “cost-to-retail ratio,” calculated by:

(Cost price ÷ Retail price) x 100%

This helps determine:

- Inventory value at the end of a period: Subtract sold product value from total retail value.

- Markup percentage: This crucial metric helps analyze profits and adjust pricing strategies.

Choosing the right inventory valuation method:

While the retail method shines in convenience, different approaches suit different needs. Here are some popular options:

- LIFO (Last-In, First-Out): Ideal for fluctuating prices, valuing remaining inventory at the latest purchase cost.

- FIFO (First-In, First-Out): Assumes older items are sold first, suitable for perishable goods.

- Weighted Average: Averages the cost of all inventory items, regardless of purchase order.

- Specific Identification: Tracks each item individually, best for low-volume, high-value products.

Retail accounting: Weighing the pros and cons:

Pros:

- Quick and easy: Saves time and reduces manual effort compared to physical counts.

- Cost-effective: Minimizes the need for frequent inventory checks.

- Convenient: Enables quick financial report generation.

Cons:

- Accuracy limitations: May not be ideal for fluctuating prices or complex inventory structures.

- Estimated values: Provides approximations, not exact inventory figures.

Retail vs. Cost Accounting:

Cost accounting delves deeper, considering costs beyond purchase price, like production and overhead. It offers higher precision but requires more complex calculations.

Remember:

- Choose your accounting method carefully, as changing requires IRS approval.

- Consider outsourcing accounting tasks as your business grows.

Ready to master retail accounting? This blog is just the beginning. Stay tuned for more in-depth explorations of specific methods and industry-specific applications. And if you’re feeling overwhelmed, remember, expert help is always available!

Bonus tip: Check out the mentioned online consultation with BooksTime experts for personalized guidance on managing your retail finances.

By understanding and leveraging the power of retail accounting, you can unlock efficient inventory management, informed decision-making, and ultimately, pave the way for your retail business’s success!